VMG Health Associates Explain Fair Market Value and Referral Risks at Town Hall

Bartt Warner, director of compensation arrangements at VMG Health, and Dylan Alexander, manager for business valuation and transaction advisory at VMG Health, presented information to Texas Ambulatory Surgery Center Society members on May 27 about fair market value in the surgical center industry, as well as an Office of Inspector General opinion that speaks directly to ASC investment concerns.

VMG Health is a company that specializes in healthcare valuation, strategy and compliance. The company provides fair market value on all assets of the medical field, from equipment to physician salaries, and has developed experts to look at each component of the industry to satisfy customers’ total needs. It also helps with tailoring a compliance program specific to your organization that will ensure compliance with Center for Medicare and Medicaid Services, as well as other governmental regulations.

Warner and Alexander spent the first part of their presentation going over ASC trends nationally, as well as in Texas. Overall, there has been enormous growth in the ASC market space. “As ASCs became more popular, healthcare providers realized that they’re a lower cost of care, less fixed and variable expenses, shorter patient stays and, in many cases, have greater quality of care,” Alexander said.

Texas ASC growth follows the national pattern, with the majority of the ASCs belonging to metro areas such as Dallas and Houston, which makes sense, because ASCs tend to pop up around hospitals, leading to greater alliances between the two, when it comes to the ownership structure of an ASC. This is significant when considering OIG opinion 21-02 — crucial to the complexities of ownership and possibilities of fraud that come with it.

OIG opinions are legal opinions that pertain to fraud and abuse of authority that are posted for the requesting parties. While these judgements are not necessarily common law for every medical site to follow, they offer safeguards and recommendations through real-world examples.

Warner and Alexander took the time to go over the background information of opinion 21-02, which specifically deals with an ASC involved with a common arrangement. A management company had 8% ownership of the ASC but no physician ownership. Along with the management company, there were several physician investors that totalled 46% investment and a health system investor that held 46% investment. With all these parties working together, it created referral risk.

This becomes an issue, because when there are multiple parties in a financial relationship, they could start to work the system to their advantage and partake in fraudulent activity by overpaying physicians, to encourage them to refer to specific facilities or tracking referrals to offer benefits to physicians who refer a lot of patients to that facility. This creates an issue with the government when patients are on programs such as Medicaid, as it increases the government’s bill and could lead to the patient being referred for unnecessary testing, in order for the physician to reap the referral benefit.

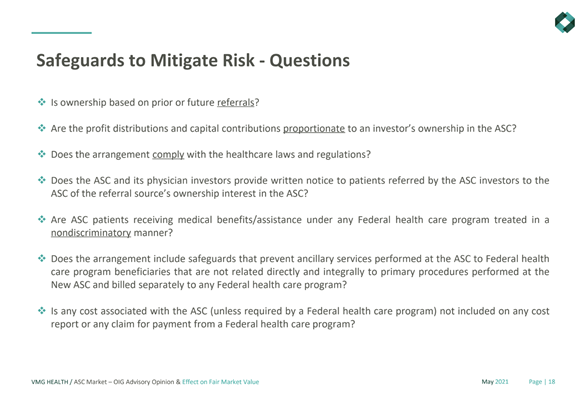

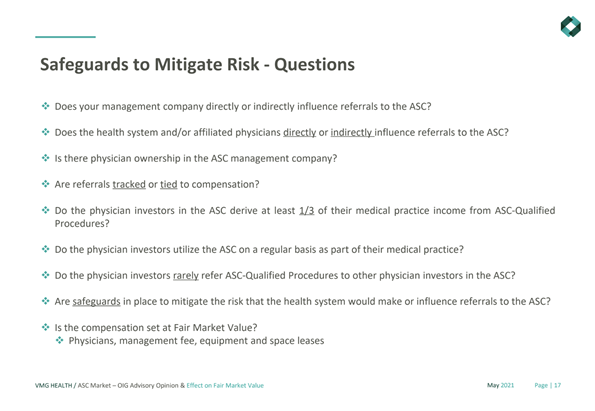

After discussing this case, Warner and Alexander took the time to go over a list of questions ASCs should be asking to help safeguard their facilities from any referral risk that could lead to civil or criminal charges.

Dylan emphasized that ASCs should not be tracking referrals, especially, as there is no real reason to do this, and it ultimately looks suspicious to the government.

The VMG Health associates tied this back to the significance of market trends and the fair market value assessments they make, as it is the only value that can be accurately used to help prevent these civil or criminal charges and ensure ASCs are up to regulation standards in the economic department.