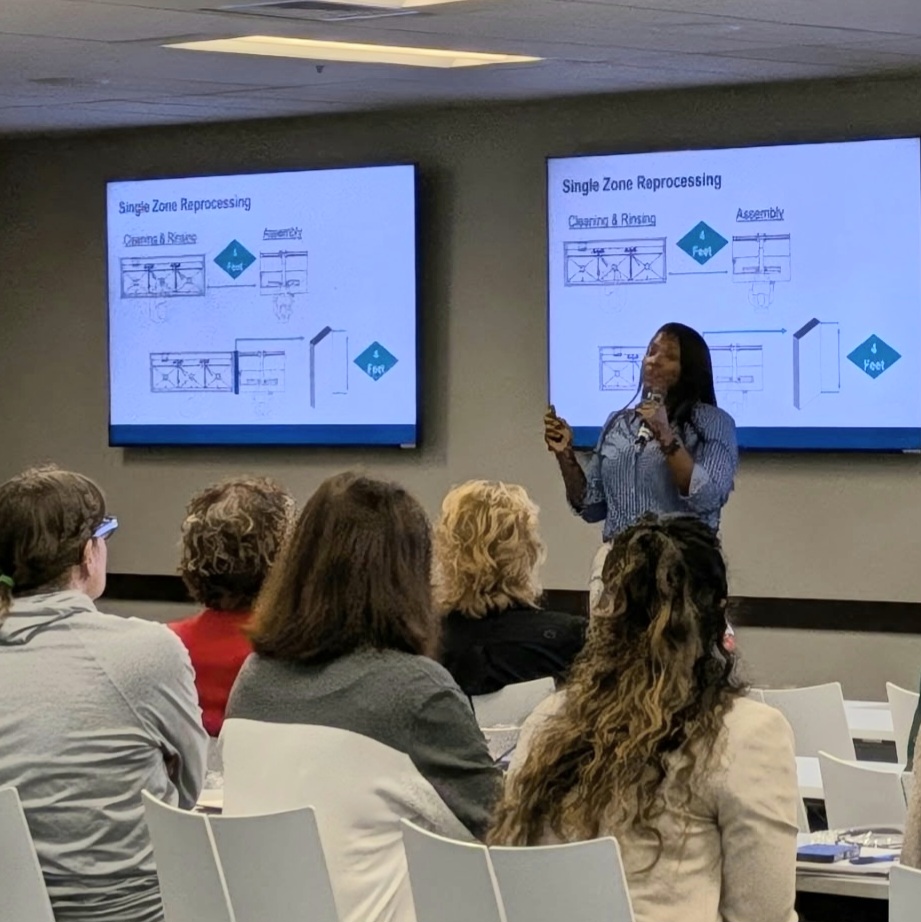

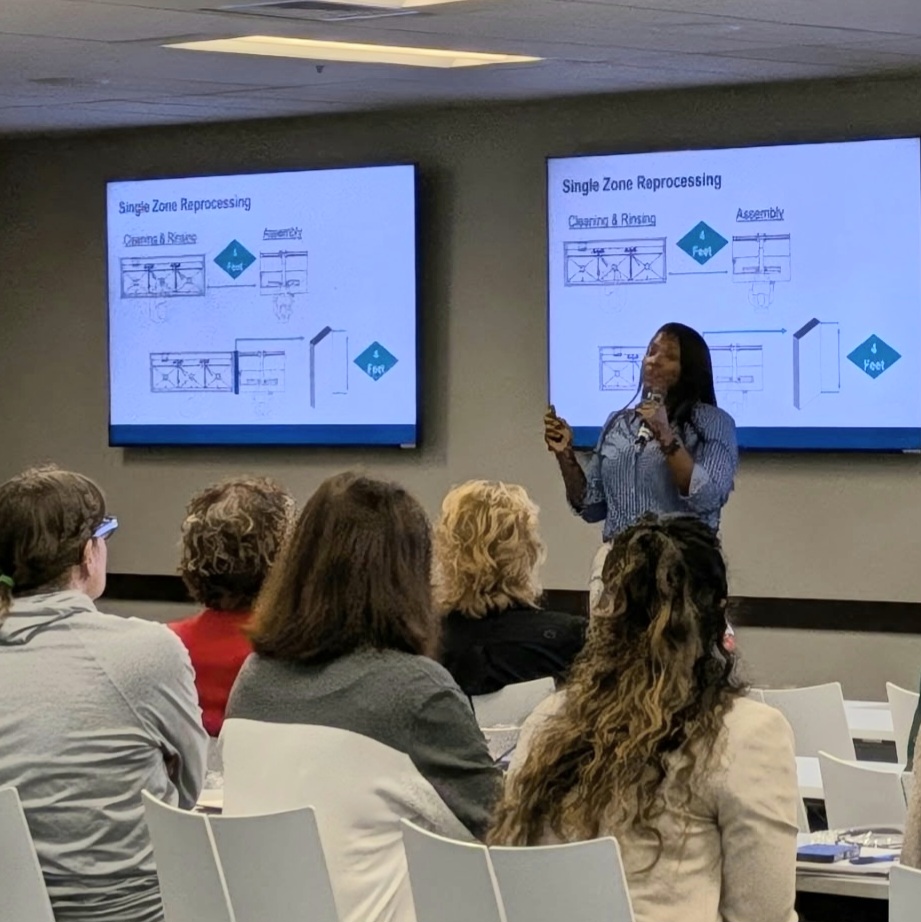

On September 12, the Texas Ambulatory Surgery Center Society (TASCS) hosted its annual Infection Control Seminar. Ambulatory surgery center (ASC) administrators, directors of nursing, and infection control specialists gathered to spend the day learning the newest updates and guidelines regarding infection prevention.

Topics included Preventing Surgical Lawsuits, Surveillance for Surgical Site Infections, and Building an Infection Control Program That Works. Speakers from all over the state and from well-known companies like

Steris came to share expert insight.

“The speakers and content were top notch, thanks to our co-chairs, Robin Rizzetto of

AMSURG and Lisa Flinn of

SCA Health," said Executive Director Krista DuRapau.

The event, held each year by the Texas ASC Society, is just one of many that helps keep ASC professionals educated and informed.

TASCS President Adam Hornback stated, "This just shows the level of commitment the ASC industry has to protecting patients and keeping infection rates low in our centers."

Thursday night, attendees gathered for a networking event before Friday's seminar, which was held at Surgical Care Affiliates in Irving, Texas; in fact, the seminar wouldn't have been possible without SCA's support and partnership, which is a value to the society and the industry.

"It was a really fun day of learning and connecting," Flinn shared. "It really made us look at our centers and patient care and how we can continue to improve processes."

January is Glaucoma Awareness Month, a time to learn about and educate others on glaucoma, an eye condition that damages the optic nerve and is the leading cause of vision loss and blindness in the United States.

January is Glaucoma Awareness Month, a time to learn about and educate others on glaucoma, an eye condition that damages the optic nerve and is the leading cause of vision loss and blindness in the United States.

The Texas Ambulatory Surgery Center Society (TASCS) has spent over 10 years bringing healthcare professionals together, providing them with educational information, networking opportunities, and updates on ambulatory surgery center (ASC) developments. This year, attendees can pack their favorite Hawaiian shirts for the

The Texas Ambulatory Surgery Center Society (TASCS) has spent over 10 years bringing healthcare professionals together, providing them with educational information, networking opportunities, and updates on ambulatory surgery center (ASC) developments. This year, attendees can pack their favorite Hawaiian shirts for the